LEKOIL Updates Nigeria in H1 Results

Thursday, August 27, 2020

LEKOIL has announced its final audited results for the year to 31 December 2019.

Operational Highlights

Otakikpo

- Production levels averaged approx. gross 5,305 bopd (2,122 bopd net to LEKOIL Nigeria)

- Updated Competent Person’s Reports announcing a significant upgrade to 2P oil reserves estimates and prospective resources (unrisked) for LEKOIL Nigeria’s working interest in the field

- Field License renewed

- Phase Two plans underway, subject to the securing of funding, for a five to seven well drilling program, targeting the increase of production to around gross 15,000 to 20,000 bopd (6,000 – 8,000 bopd net to LEKOIL Nigeria)

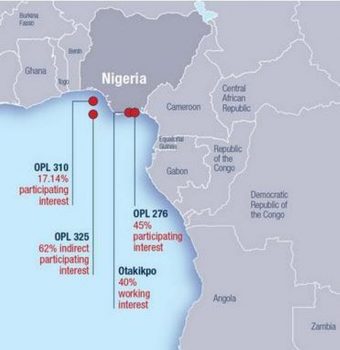

- OPL 310

- Advanced plans for the Ogo appraisal drilling program with well locations selected. Funding discussions currently underway with industry partners

- LEKOIL executed a legally binding Cost and Revenue Sharing Agreement (‘CRSA’) to progress the appraisal and development program activities at the OGO discovery and conversion to an Oil Mining License (‘OML’)

- OPL 310 License extended to 2 August 2022, following the payment of an extension fee by LEKOIL

- OPL 276

- Acquired 45% participating interest in the Production Sharing Contract (‘PSC’) in relation to the Oil Prospecting License 276 from Newcross Petroleum (subject to receipt of required consents)

- Preliminary resource estimates by Newcross, based on four wells resulting in four discoveries, reported gross recoverable volumes of 29 million barrels of oil and 333 Bcf of gas, upside of 33 million barrels of oil and 476 Bcf of gas (recoverable)

- OPL 325

- Execution of the PSC in relation to the Oil Prospecting License 325 expected to occur in 2020

- On executing the PSC, LEKOIL intends to farm-down a portion of interest following a detailed prospect and lead risking study

- Financial Highlights

- Equity crude sales proceeds of US$42.0 million

- Total production from the Otakikpo marginal field for the year at 759,666 barrels net to LEKOIL Nigeria

- The Group lifted 677,788 barrels for the year 2019, realizing an average sales price of approx. US$62 per barrel

- Loss for the year of US$12.0 million (2018: loss of US$7.8 million)

- Cash and bank balances of US$2.7 million as at 31 December 2019 (31 December 2018: US$10.4 million). Cash balance at 31 July 2020 of US$0.6 million

- As at 31 December 2019, total outstanding debt financing, net of cash, was US$16.5 million (31 December 2018: US$10.1 million)

- Target an immediate reduction of at least 40% in general and administrative expenses annually following the significant drop in oil prices in the first half of 2020Lekan Akinyanmi, LEKOIL’s CEO, commented: “The priority for 2020 is to advance towards the start of the drilling programs at both Otakikpo and Ogo in OPL 310. The next two years will prove to be transformative and provide key catalysts for value appreciation for shareholders through the drill bit as we advance in building a leading Africa-focused exploration and production business.”

- LEKOIL’s annual report and accounts for the year ended 31 December 2019, together with the Notice of Annual General Meeting will be posted to shareholders shortly and a further announcement will be made as and when this has occurred. The Company also intends to publish an operational update and financial guidance for FY 2020 in short order.

« GO BACK

You may also like